If you live in a location with regular negative climate, you may want to select a lower extensive insurance deductible to limit what you pay out of pocket. At the exact same time, you can maintain your crash insurance deductible greater to balance out your vehicle insurance premium.

Because instance, your vehicle insurance coverage premium would certainly set you back more to counter the $0 vehicle insurance policy deductible - insurance company. When Do You Pay A Vehicle Insurance Coverage Deductible? Here are the main scenarios in which you 'd be accountable for paying an insurance deductible: If you trigger an auto accident and also your auto needs repair work, you'll pay your insurance deductible on your accident insurance coverage - cheapest auto insurance.

cheapest car cheaper auto insurance auto insurance car insurance

cheapest car cheaper auto insurance auto insurance car insurance

Exactly how To Choose A Vehicle Insurance Policy Insurance Deductible Since you recognize what a vehicle insurance coverage deductible is, it is crucial to choose the ideal insurance deductible for your situation - low cost auto. You ought to select a high automobile insurance policy deductible if you wish to reduce your monthly costs as well as if you have the capacity to pay it (vehicle).

If you don't have any kind of savings, it's not a wise idea to have a high insurance deductible. You could be the best vehicle driver in the globe, but you still share the road with poor chauffeurs and uninsured drivers (low cost auto). According to the Insurance Policy Information Institute, regarding 6 percent of drivers that had accident insurance coverage sued in 2018.

You can constantly choose a lower deductible while you conserve up a reserve and afterwards raise the deductible later. You need to pick a reduced auto insurance deductible if you do not have the capacity to pay a high one, or if you wish to protect your out-of-pocket costs. A low insurance deductible might be a great idea if you live in a congested location where you have a higher possibility of experiencing an accident (low cost).

Some programs will reset your insurance deductible to the complete amount after you make a case, as well as others will reset it to a smaller amount - business insurance. After five years, you would certainly have paid an added $100 or even more to your insurance firm.

What Does What Is Comprehensive Insurance? - The Hartford Do?

What Takes place If You Can Not Pay Your Deductible? If you are incapable to pay the rest of your expenses for the insurance deductible, you may have some Click here for more info choices.

Recognizing when to adjust your insurance deductible as well as when to go shopping around for a new cars and truck insurer with economical prices is the most safe method to avoid high costs in the future. Our Referrals For Auto Insurance Searching for vehicle insurance policy does not have to be hard. Just make sure to obtain quotes from several carriers, so you can compare rates.

insure perks cheap car insurance cheapest car insurance

insure perks cheap car insurance cheapest car insurance

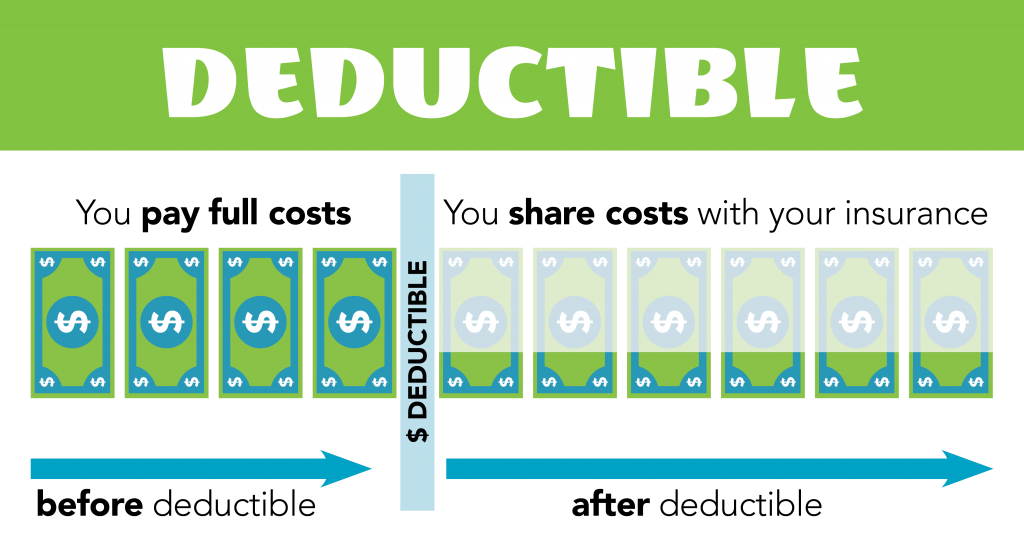

An insurance deductible is the quantity you are required to pay of pocket when submitting an insurance claim. You probably discussed them when you initially bought your insurance policy coverage (cheap auto insurance). If you don't review your insurance coverage yearly, the next time you also hear the word "insurance deductible" might be months or even years later when you're submitting a case - cheap auto insurance.

/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg) money cheaper cars credit score auto

money cheaper cars credit score auto

In these circumstances, the comprehensive insurance deductible will use. Likewise, you may see that some coverages don't need an insurance deductible, like arranged insurance coverage for precious jewelry or various other important things, as well as home owners' or auto liability protection. In these instances, you will not have to pay any out of pocket expenses if you need to sue.

Deductibles additionally affect your rates. The higher the deductible, the lower your costs. cheapest car insurance. Significance, if you're eager to pay even more out of pocket when suing, your month-to-month or semiannual settlements will be smaller. On the flipside, if you're willing to pay more in costs, your deductible will certainly be lowered. cheaper car.

For example, if you have actually obtained a fairly new house, you may not have the very same threats as an older house as well as might not be as most likely to file a claim. In which situation, it might be far better to have a higher deductible and reduced costs. And considering that different insurance coverages within your policy have different deductibles, your costs as well as deductibles can become a lot more personalized.

The smart Trick of $500 Or $1000 Auto Insurance Deductible? - Policy Advice That Nobody is Discussing

Your insurance policy agent is the ideal person to chat to when making these choices., for help evaluating your deductibles and making sure that you're paying the best amount for your current threats.

vehicle insurance insurance affordable cheap car low-cost auto insurance

vehicle insurance insurance affordable cheap car low-cost auto insurance

For certain insurance coverage information, constantly describe your plan. If the plan coverage summaries in this post conflict with the language in the plan, the language in the plan uses.

Exactly how Does an Insurance Coverage Insurance Deductible Work? A cars and truck insurance insurance deductible is the amount you will pay out of pocket on an insurance claim before the insurance policy cash kicks in. You choose the amount of your insurance deductible when you buy your automobile insurance coverage. As well as if your scenarios alter, you can alter your deductible amount - car.

For illustration purposes, below is how car insurance deductibles work: You get a plan with a $500 insurance deductible. If you get right into a mishap or other covered event you will certainly require to pay the $500 insurance deductible prior to the insurance policy firm starts paying for the remainder. Insurance deductible amounts differ, but recognizing the advantages and downsides to choosing a lower or greater amount will certainly help you make your decision on what is the right suitable for your needs - insurance company.