Your insurance can additionally be terminated for other factors. Here are a few other circumstances that might result in the cancelation of an automobile insurance coverage policy: Your license is suspended or withdrawed. perks. You really did not provide precise documents, or you stopped working to reveal important info or made significant misstatements when you looked for the policy (even if accidentally).

car insurance cars money prices

car insurance cars money prices

A lower credit rating can make it harder to get authorized for financings, charge card, real estate, energies or anything else that calls for a credit rating check. In circumstances where you are accepted for funding, you'll likely deal with higher rates of interest - business insurance. In addition, having a plan cancellation in your past can trigger future insurers to charge you a lot more for a new policy.

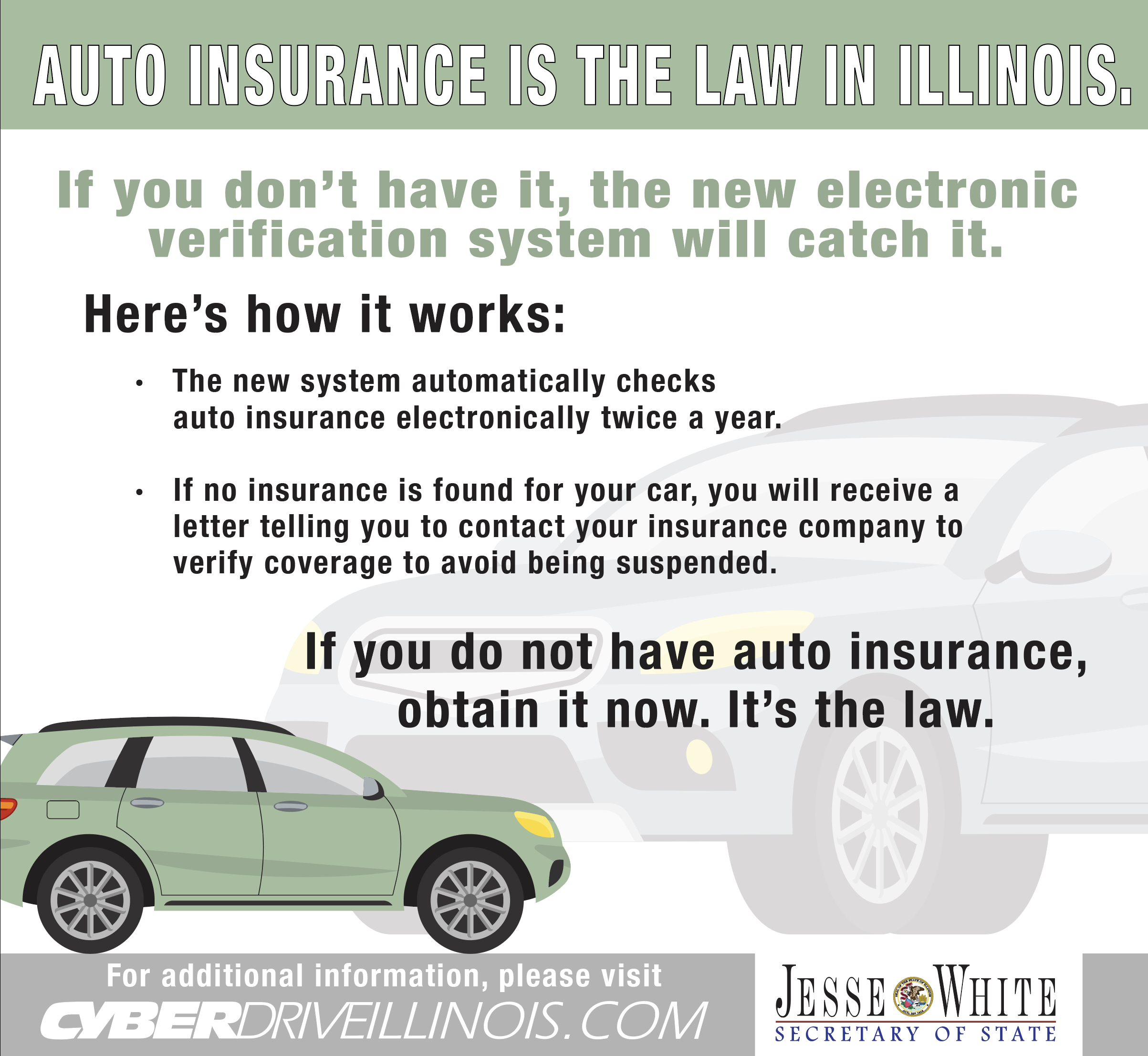

When a chauffeur's car insurance policy is canceled, the insurance company informs the proper automobile department. Some states require an insurance policy to be in position for the whole duration of a vehicle's enrollment duration, as well as may call for tags to be surrendered if brand-new insurance coverage isn't safeguarded (vehicle insurance). Driving without insurance policy coverage could lead to stiff penalties, greater insurance premiums in the future, and also the loss of your certificate.

low cost auto cheapest auto insurance car cheaper car insurance

low cost auto cheapest auto insurance car cheaper car insurance

For instance, they may delay the due day to provide you even more time to pay your expense. cheap car insurance. If you have the ability to fulfill that month's payment, it might likewise be helpful to speak with your insurance policy service provider concerning lowering your costs repayment (cheap car insurance). You may be able to accomplish this in numerous ways: An insurance deductible is the quantity you pay prior to your insurance protection starts if you're involved in a crash.

The Greatest Guide To What Happens If You Don't Pay Car Insurance In San Francisco ...

Doing so may drive down your premium. Car insurance business in many states element your credit history into your insurance coverage costs by utilizing what are called credit-based insurance coverage scores. Improving your credit rating can conserve you money on your car insurance coverage. If you remain to miss out on settlements, your insurance policy company will likely deactivate your plan, as well as there might be nothing you can do.

If this is the situation, make sure you submit your settlement by that date to see to it your plan remains in area - low cost. If you do not assume you can pay by then, call your insurance coverage company to figure out if there's any kind of wiggle space. car insured. What to Do After Your Car Insurance Is Terminated, Depending upon your state's laws as well as your own financial circumstance, your alternatives after having your insurance coverage terminated can differ.

Using for a brand-new policy with your previous insurance company might be an option, but it's feasible they'll reject to take you on as an insurance policy holder. If you are approved, you're likely to be charged much greater insurance policy prices - auto. If your previous insurance firm won't take you back, you'll have to look for protection elsewhere.

It's a good idea to check your credit regularly so you recognize where it stands, and also to help you see how your settlement background and various other economic habits influence the health of your credit score. insurance company. You can examine your credit history report for free on Experian anytime (cheapest auto insurance). Improving your credit rating can help you decrease your vehicle insurance coverage premium, yet it can take time.

The Main Principles Of Can Your Car Insurance Company Send You To Collections?

insurance company cheapest car insurance cars auto

insurance company cheapest car insurance cars auto

Summaries of coverages and also policy functions are for informative objectives just. In the occasion of loss, the real terms and also problems establish forth in your policy will certainly determine your insurance coverage.

It is underwritten in AZ by Hartford Insurer of the Southeast; in CA by Residential Or Commercial Property as well as Casualty Insurance Policy Firm of Hartford; in WA, MI and also MN, by Trumbull Insurance Provider; in MA, by Trumbull Insurance Provider, Guard Insurer, Hartford Insurance Coverage Company of the Midwest, and Hartford Mishap and also Indemnity Company; and in PA, by Hartford Underwriters Insurance Policy Business - credit.

Cost savings and advantages may vary and some applicants may not certify. The Program is currently unavailable in Canada as well as united state Territories or ownerships (affordable). * Client evaluations are gathered as well as arranged by The Hartford as well as not representative of all consumers.

What to do if you have actually missed a payment, If you miss out on a vehicle insurance coverage payment, there is most likely no demand to panic - car insurance. If it is your initial missed out on payment, your insurer might allow it glide, assuming you are not numerous weeks past due. In this instance, contact your insurance company as quickly as you realize the due date has actually passed.

The 7-Second Trick For What Happens If I Don't Pay My Car Insurance? - Policygenius

Make the settlement as soon as feasible, and also if you are not registered in autopay, think about registering to avoid missing a settlement in the future. Many insurance coverage firms, like Allstate and Amica, supply a tiny discount rate for vehicle drivers who established autopay. If you missed your repayment by a few days, If your vehicle insurance policy payment is numerous days late, the circumstance can be much more major. credit.

low cost dui liability cheaper car

low cost dui liability cheaper car

Lots of vehicle insurance provider supply an elegance period, which gives you some additional time after the preliminary target date to pay your costs. Every insurer has a different elegance duration, but it commonly varies from 10 days to 1 month. If you are still within the elegance period when you realize your payment is late, you can most likely make the payment without encountering any type of fines.

If your auto insurance has actually been terminated, If you are constantly late on your settlements, your insurance coverage business will Click here likely eventually terminate your plan for non-payment (car). You ought to get a notice of the cancellation, so this should not come as a surprise - car. When your automobile insurance coverage obtains canceled, you are not allowed to drive lawfully.

Having a gap in insurance policy coverage can cost you cash out of pocket, and it could be much more challenging to get insurance coverage in the future - suvs. Right here are some of the most significant charges you could deal with: As pointed out, your auto insurer will ultimately terminate your policy when you have missed out on a certain variety of payments or get too behind - low-cost auto insurance.