Compare Vehicle Insurance Coverage Rates Currently you recognize that different aspects assist identify just how much you spend for cars and truck insurance coverage. Among one of the most reputable means to lower your cars and truck insurance coverage premium is to contrast various insurance policy carriers, which is something we concentrate on at Cost-U-Less Insurance coverage. If you pay for your insurance policy one month at once, you can typically exchange insurance coverage service providers whenever you intend to.

If you do not have automobile insurance, your vehicle driver's certificate can get put on hold as well as your vehicle took. After suspension, you have to file and also maintain evidence of cars and truck insurance coverage with the California Department of Motor Cars for three years. Insurance provider will certainly send you a card to show evidence of cars and truck insurance policy, so make sure to keep it in your vehicle to stay clear of these repercussions.

Mercury provides more than 1,000 independent agents in California - liability. The Golden State Car Insurance Coverage Discounts & Perks Mercury currently supplies some of the most affordable insurance coverage rates offered.

Considering that then, it's not only end up being the biggest economy in America yet also the fifth-largest economy in the world, vanquishing the UK. It's not a surprise considering that The golden state offers a lot, from the glittering oceans in San Diego completely as much as the stunning mountains of Sierra Nevada (cheaper).

Regarding Us Mercury Insurance policy was started in 1962 by George Joseph. Today, it is a multi-line insurance coverage firm providing primarily personal automobile and also home owners insurance coverage through a network of independent representatives and brokers.

The Of How California Traffic Tickets Affect Auto Insurance?

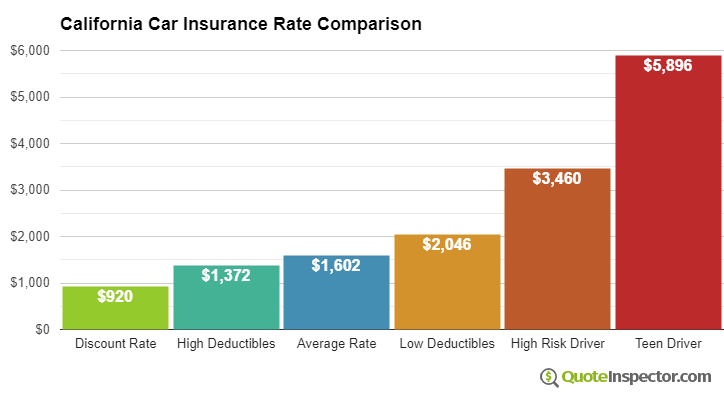

According to the Insurance Coverage Details Institute, the average California vehicle driver pays about $1,034 a year for car insurance policy. That makes The golden state the 19th least expensive state for vehicle insurance coverage in the U.S. That does not suggest you can not conserve even more money on your automobile insurance policy. Continue reading to find the very best automobile insurance coverage for you, your vehicle, and most importantly, your spending plan.

In the areas listed below, we've evaluated countless quotes and also broken down the most effective automobile insurance policy prices for all various sorts of California drivers - suvs. Young or old, excellent driver or spotty document, Nor, Cal approximately, Cal, we have actually got the most effective prices for you. Continue reading to discover exactly how to conserve some significant cash on your following cars and truck insurance coverage.

Just because these companies provide the most affordable average rates for teen drivers, it does not imply they'll be the least expensive for you or your child. Auto insurance provider take a variety of variables into consideration when determining their rates, so it is very important to look around as well as contrast quotes from numerous firms to make sure that you can be sure you're obtaining the most effective bargain.

When contrasting vehicle insurance policy prices for teenagers and young motorists, you may be stunned to discover that both teams will certainly pay the very same amount with Hugo Insurance provider $65/mo. Nevertheless, that's where the resemblances end. Teenager drivers can see rates as high as $223/mo (Bridge, Internet), while the highest possible typical young chauffeurs can anticipate to pay is $132/mo (Safe Vehicle).

Large distinction? While these are the most budget-friendly business on standard, you still desire to contrast prices to see which firm will certainly supply the finest prices for you based on your background, demographics, and various other elements.

8 Simple Techniques For Some Of The Reasons Your Car Insurance Will Likely Go Up - Wthr

These are some of the most affordable prices for retired motorists generally, yet make certain to still look around to compare vehicle insurance policy prices among various firms as well as think about the price cuts you may be eligible for to more decrease your regular monthly costs - insurance. Cheapest CA Companies for Married Drivers Love apart, marital relationship includes several advantages one being a decrease in car insurance coverage prices.

As you can see, the monthly insurance coverage rates double from Hugo at $41/mo to Foremost at $81/mo (auto). Also within this listing of the most cost effective insurance policy service providers, you want to be sure you pick the firm that will finest match your spending plan without sacrificing high quality protection. Least Expensive Quotes for Solitary Drivers Just due to the fact that you haven't made it down the aisle does not suggest you need to overpay for auto insurance.

While a married motorist insured by Workmen's will pay a month-to-month premium of $74, a single driver will be stuck paying $87/mo (cheap auto insurance). This $13 distinction might not seem like much, but it can promptly include up. In a year, you can pay over $150 even more in auto insurance policy premiums. Given that your car insurance policy rates have a tendency to be a bit higher as a solitary driver in The golden state contrasted to a married vehicle driver, be certain to look for discount rates that will certainly help decrease your regular monthly insurance policy costs.

While the differences are minor, you'll see higher prices for guys within the same insurance company - trucks. Ladies insured by Metromile will certainly delight in prices of $61/mo, while guys will certainly need to pay a bit a lot more at $64/mo. Gender apart, there is a slew of variables that impact the rate an insurance policy company estimates you, so be sure to compare the insurance coverage prices.

These are large enter insurance coverage prices that can make a big effect on your month-to-month budget plan. When comparing the rates of full protection insurance policy to the state minimum in California, you'll discover that full coverage is more costly typically - cheaper car insurance. Let's claim you choose to acquire state minimum insurance policy from Flexibility.

The Best Guide To California Car Insurance Coverage

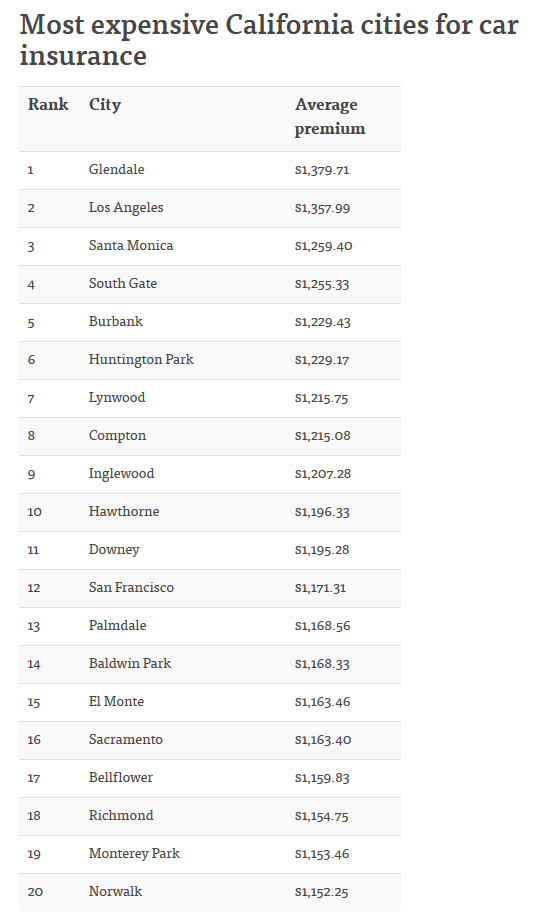

Nevertheless, if you make a decision that you prefer to have complete insurance coverage insurance coverage with Flexibility, you'll pay over $90 more at $134/mo! So, when considering complete coverage auto insurance coverage, be sure to compare rates to locate the most inexpensive alternatives for you (insurance companies). The Majority Of Cost Effective Insurance Policy for Vehicle drivers in The golden state's Major Metropolitan Locations Relying On where you live in The golden state, the car insurer that can use one of the most inexpensive prices will certainly differ.

Least Expensive Car Insurance Policy for California Suburbs As you head out of the significant cities to the suburbs like San Bernardino County, car insurance coverage rates and the most effective company to choose for affordable insurance policy varies a bit, but stays rather consistent. Right here are the very best companies to pick from for inexpensive obligation insurance coverage in the California suburban areas. auto insurance.

Geico uses the most budget friendly rate at simply $21/mo complied with by Progressive at $24/mo. Initial American P&C ($26/mo), Mercury ($27/mo), as well as Infinity ($27/mo) deal comparable rates as they complete the least expensive automobile insurance coverage providers in rural California. The Most Effective The Golden State Car Insurance Policy Discounts Among the ideal methods to decrease your vehicle insurance price is to make use of discounts provided by the insurance provider. insurance.

If you guarantee multiple automobiles on your plan you can save approximately 25% on your costs with a multi-car discount. When you also require insurance policy for your house, house or perhaps life insurance policy, packing it with your vehicle insurance coverage under the exact same policy can additionally help you conserve up to 25% on your costs contrasted to guaranteeing them independently.

Not just do you reduce your premium, however you likewise don't have to stress over forgetting to make your payment every month. Ensuring your automobile has some of the most up to date security functions can help you conserve a bit on your auto costs. A few of the functions that will earn you a discount consist of having anti-lock brakes as well as digital stability control.

10 Easy Facts About The Ultimate California Car Insurance Guide (Costs + Coverage) Explained

You may require to use a telematics tracking system to do so, yet the cost savings can be worth it if you can fulfill the requirements. As long as you complete a state-approved course, you ought to be able to enjoy this discount rate.

On this plan, you generally have a low regular monthly base rate as well as pay extra based on the variety of miles you drive. Have you been with the very same insurer for a long period of time? If so, you may be qualified for a customer commitment discount (auto). If you're presently a high institution or college pupil living in The golden state, you can conserve money on your insurance policy premium with the great student price cut.

You have to lug this proof with you at all times, in instance you are in a mishap or quit by the authorities. California additionally requires insurance firms to online report insurance details for private-use lorries, so that the DMV can identify whether or not you fulfill the coverage demands.

Keep this in mind when you're shopping, and be sure to get the most ideal coverage for you. The golden state's One-of-a-kind Car Insurance coverage Rules Cars and truck insurer make your motoring history one of the major consider computing your costs (business insurance). A 20 percent discount rate is guaranteed for vehicle drivers who have been accredited at the very least 3 years, have no even more than one point on their documents in the last 3 years and haven't been located liable in a major crash in the last 3 years - cheapest car insurance.

On the other end of the spectrum, people in West Hills pay an ordinary price of more than $100. Would like to know where your city drops in that array? We have actually assembled a list of typical prices for almost 300 cities throughout California: Click the name of each city in the table above to find in-depth failures on all the variables that enter into calculating your month-to-month premium.

A Biased View of Best California Health Insurance In 2022 - Benzinga

The very first time around you'll get a penalty of up to $250 along with charge evaluations. Fine evaluations can differ based upon where you live however range from $1 for every $10 up to $10 for each $10 you owe in charges. That indicates if your fine is $100, you can owe approximately an extra $100 in penalty assessments which increases the complete amount you need to pay.

Your best wager for safeguarding vehicle insurance policy without a certificate is to work with a smaller sized insurance business that could be extra flexible with their requirements. All data referenced in this short article originates from a combination of exclusive data which is accumulated from countless actual client quotes with Contrast.

Whether you're a beginner to the Golden State or you've lived right here for years, you likely currently recognize the regulation: Auto insurance coverage is legally required to drive in The golden state. (That requirement makes a whole lot of sense, toocar insurance coverage is valuable security for everyone when traveling, considering that it aids ensure that no person gets stuck to a huge liability costs after a mishap.)What you could not understand, though, is that if you're a low-mileage driverespecially if you drive much less than 10,000 miles per yearyou could be able to save a lot on your car insurance plan with Metromile's pay-per-mile vehicle insurance policy (cheaper car).

You'll pay a price that might be as low as 6 cents per mile you drive. In other words, you'll pay for the miles you really drive. With Metromile, the less you drive, the much more you could save.

California Automobile Insurance Whether you're following the coastline or heading to Hollywood, you'll need car insurance coverage in The golden state. The AARP Vehicle Insurance Program from The Hartford has been protecting AARP participants in California and also their family members since 1984. 1 Throughout this time, we've made a high insurance rating and a reputation for integrity.